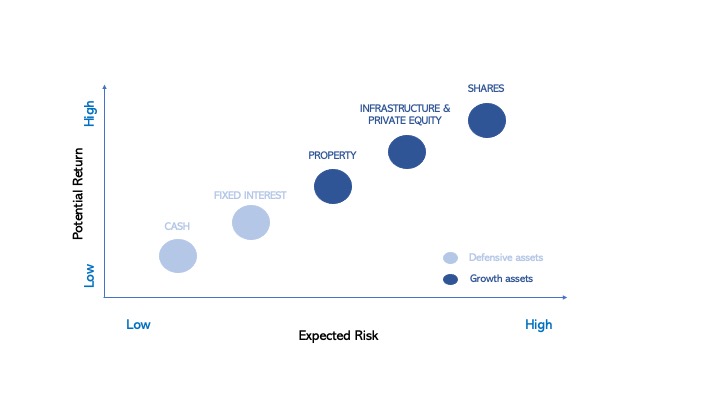

Asset classes are the building blocks of your investments and are commonly grouped as defensive or growth depending on their different characteristics. The exposure you have to each asset class should normally be decided upon based on your risk/return profile – i.e. how much risk you are willing to take on in order to achieve the returns you need to accomplish your retirement goals.

The different characteristics of growth and defensive assets are outlined below:

| Types of assets | Defensive | Growth |

|---|---|---|

| Asset classes |

|

|

| Risk / Return characteristics | Lower returns and less volatility over the long term than growth assets. | More volatility and risk than defensive assets, however with a higher potential return over time. |

| Within a portfolio | Stabilise and diversify returns. | Deliver higher growth over the long term. |

Generally, the higher potential returns of an asset class, the higher the risk associated with that asset class.

As shown in the table above, shares are a growth investment and tend to exhibit higher returns over time but at a higher risk. In contrast, Cash and Fixed Interest are seen to carry lower levels of risk but with a lower potential long-term return. It is important to remember that returns may not always be positive, regardless of the asset class in which you are invested.

Descriptions of the typical asset classes are provided below:

Cash

Cash is generally a low-risk investment and often included in a portfolio to meet liquidity needs and stabilise returns. It is usually the least volatile type of investment and tends to have the lowest return over a market cycle. Cash comprises deposits with banks and money market securities (such as bank bills and promissory notes) that are issued or guaranteed by a government, bank or corporate entity. Whilst low risk, a cash investment means you’re typically lending money to governments or businesses that could default on the loans, resulting in a loss on your investment.

Fixed income

Fixed income means you are effectively lending money to governments and businesses. There are different types of fixed income securities which will have different returns and volatility. For example, bonds are a common form of fixed income. As with cash, Fixed income securities are usually included in a portfolio for their relatively stable return characteristics. Returns typically comprise interest and changes to the market value of the security. When interest rates rise, the value of a fixed interest security can fall and when interest rates decline, values can rise. Market values may also fall because of default concerns. When interest rates are low, the risk of rates rising and market values falling, is at its highest.

Australian shares

Australian shares, also known as equities, comprise investments in companies listed on the Australian Securities Exchange. They can be volatile and are normally included in a portfolio for their growth potential. Returns usually comprise two components – the companies’ profits which are paid to shareholders, known as dividend income, which may have the benefit of tax credits attached to them (known as franking or imputation credits), and fluctuations in share prices. It is common to separate the asset class into two categories – large capitalised companies and small companies. An investment in a small company can exhibit great volatility and a higher risk/return profile than those of the larger companies.

Global shares

Global shares comprise investments in companies listed on securities exchanges around the world. They can be volatile and are normally included in a portfolio for their growth potential. Returns usually comprise dividend income and movements in share prices. Returns are driven by many factors including the global economic environment and country specific conditions. Investing in global shares means that there is less exposure risk to a single economy or country and diversifies risks across a range of countries and large number of companies. Global shares can also be separated into large and small company investments.

Property and infrastructure

Property and infrastructure are often spoken about together in investment terms as they share some similar traits, an important one being that they are both forms of ‘real assets’ which contain physical assets we can see in everyday life. Property investments include land, commercial or industrial property, and residential property. Infrastructure investments can include investments in transportation, utilities, communication and infrastructure for energy. Returns from property and infrastructure are typically not wholly correlated to those of shares and the health of the economy, and they generally provide the potential for steady cash flows and long-term capital growth. Both investments can come with the risks of illiquidity, high establishment and operating costs, leverage and regulatory risks.

Alternative investments

Alternative investments can be broadly categorised as either Growth Alternatives or Defensive Alternatives depending on the type of investment. ‘Alternatives’ cover a wide range of investments with unique characteristics and seek to invest in non-traditional assets. They are typically more illiquid investments than their more mainstream counterparts such as equities and traditional fixed income. Examples of alternative investments include private equity or venture capital, hedge funds, managed futures, art and antiques, commodities, and derivatives contracts. Some real estate and infrastructure investments can also be categorised as ‘alternative.’

Issued by Diversa Trustees Limited (ABN 49 006 421 638), (AFSL No 235153).

This article is general advice only and does not take into consideration your personal objectives, financial situation or particular needs. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.