What is compounding?

Compounding is when you invest and earn interest on your interest. When you invest a sum of money, not only do you earn interest on the money you invest, but you can also earn on the interest you earn from that investment.

For instance, if you invest $1,000 into a savings account and earn 5% interest compounded annually, in the first year your interest earnings will be $50 (5% x $1,000). At the start of the second year, your investment total is $1,050 – so your interest will be calculated based on the original amount you invested, plus the interest you earned in the first year. In total, over 5 years, your investment would have grown to $1,276.28.

The power of compounding can really be seen over the longer-term, which is why it is an ideal investment approach in superannuation.

In addition, the power of compounding can be further boosted the earlier you start to invest and by any additional contributions you make to your investment.

Compounding, superannuation and long-term investing

Superannuation uses compound interest to grow your retirement savings. It is a long-term investment designed to provide you an income in your retirement. Your superannuation investment could potentially be a 40-year investment, depending on when you start working.

Over the course of your working life, your superannuation balance will grow and will likely be worth much more than what was contributed either by your employer or by you.

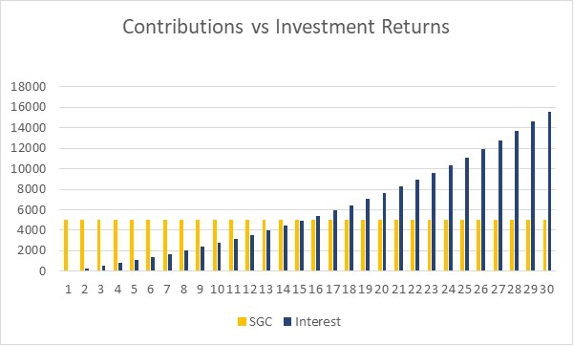

Consider the following simple example of an individual earning $50,000 who receives employer (superannuation guarantee) contributions of 10% and investment returns of 5%:

After 30 years, the superannuation balance has grown from nothing to $332,194. There has been $150,000 worth of contributions and $182,194 of investment returns. The amount of interest earned, or investment returns, is greater than the actual contributions.

Assumptions:

- Salary stays at $50,000 and SG contributions remain constant at 10%

- Contributions are made on an annual basis at end of the year

- Investment returns remain constant at 5%pa.

Contributing to super

Your account balance will further grow through any contributions that you and/or your employer make.

Your employer will make SGC (Superannuation Guarantee contributions). SGC are compulsory contributions made by your employer to your superannuation fund and for 2021/22 are at a rate of 10%. Employees are generally entitled to SGC payments when their monthly salary (before tax) is $450 or more. However, from 1 July 2022, the $450 threshold will be removed and employers will be required to make super guarantee contributions to their eligible employee’s super fund regardless of how much the employee is paid. Employees must still satisfy other super guarantee eligibility requirements. Employees under 18 must also work more than 30 hours per week to be eligible for SGC payments.

You can also make additional contributions to your super fund yourself so that you have more money when you retire. These contributions can be concessional or non-concessional contributions.

Concessional contributions refer to contributions made to your superannuation account before tax, such as salary sacrifice contributions.

Non-concessional contributions are contributions you make after tax, they can also be known as voluntary contributions. The government can also make a ‘co-contribution’ into your account if you earn less than a certain amount per year and make a voluntary contribution into your account.

To make a voluntary contribution, you can generally ask your employer to make a deduction to your super from your after-tax pay, or you can arrange the contribution yourself to your super account. You can make voluntary contributions until age 75, but once you reach age 67, you need to work at least 40 hours within 30 consecutive days, at least once during the financial year.

There are caps on how much money you can put into your superannuation fund each year.

From 1 July 2021 the concessional contribution cap is $27,500 per year for all individuals regardless of age. From 1 July 2021 the non-concessional contribution cap is $110,000 per year for all individuals regardless of age or $330,000 under the three-year bring-forward where you can contribute up to three times the cap at once or at any time during a three-year period.

To learn more about the different type of superannuation contributions, you can visit the Moneysmart website or contact your financial adviser.

How making additional contributions can boost your superannuation balance

Taking the earlier example of an individual earning $50,000pa who receives employer (superannuation guarantee) contributions of 10% and investment returns of 5%:

After 30 years, the superannuation balance has grown from nothing to $332,194.

If an additional $500 is added on an annual basis the account balance would grow to $365,414 after 30 years.

If an additional $1,000 is added on an annual basis the account balance would grow to $398,634 after 30 years.

Making additional contributions to superannuation can boost your retirement savings balance. You do not necessarily need to contribute large amounts to make a difference to the balance you end up with in retirement.

Whilst these are simple examples and returns and contributions will vary over time, they illustrate the power of compounding and contributing to your future via your superannuation account.

An additional $1,000 a year amounts to just under $20 a week, but over the course of your working life can make a large difference to the amount of money you will accumulate for your retirement.

Start early

The earlier you can start contributing additional money to your superannuation fund the better. This is because your money will be invested for longer.

For example, an individual works from age 20 to age 65, earns $50,000pa and receives employer (superannuation guarantee) contributions of 10% and investment returns of 5%.

When they retire at age 65 they will have $798,500.

If you make an additional $10,000 of contributions your balance will be larger, but the timing of those contributions can have a large difference.

For example, if you contribute an additional $1,000 pa from age 20 to age 29, your balance at age 65 would be $867,881.

If you contribute an additional $1,000 pa from age 30 to age 39, your balance at age 65 would be $841,094.

Assumptions:

- Salary stays at $50,000 and SG contributions remain constant at 10%

- Contributions and additional investments are made on an annual basis at end of the year

- Investment returns remain constant at 5%pa.

Make the most of your retirement savings

Compound interest can help to boost your retirement savings. However, if you are able to make additional contributions to your superannuation fund, then this will further boost the money you will have available to you when you retire.

You do not necessarily have to contribute a lot to make a big difference over time as the power of compound interest will work in your favour to boost your superannuation balance.

Issued by Diversa Trustees Limited (ABN 49 006 421 638), (AFSL No 235153).

This article is general advice only and does not take into consideration your personal objectives, financial situation or particular needs. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.