Choosing how to invest your superannuation is a big decision. The information contained in this article can help you learn more about what to consider before deciding where to invest, and gives you general information about the risk and return characteristics of investments generally available through your superannuation fund. This article is general advice only.

What are your needs what level of investment risk are you comfortable with?

Superannuation is likely to be one of the biggest investments you’ll have during your life. It’s important you carefully consider your needs and situation when deciding which investment options best suits you and consider speaking to a financial adviser.

What are your aims and needs?

It is important to really think about your retirement goals – whether this is five years away or fifty years away, setting goals is important and can enable you to better understand how much money you might need to live your desired retirement lifestyle.

What risks are you comfortable with?

All investments involve some type of risk. While the idea of risk can be a daunting concept for some investors, it is a normal part of investing and without it, you may not achieve the returns necessary to meet your retirement goals. This is called the risk/return trade-off. It is important for you to establish how much risk you are willing to take with your super and choose an investment mix that suits you. You will need to consider your investment timeframe and retirement goals. Below are the industry standard risk measures that can help guide you when comparing investment risk across the investment options offered.

| Risk band | Risk label | Estimated number of negative annual returns in any 20-year period |

|---|---|---|

| 1 | Very low | Less than 0.5 |

| 2 | Low | 0.5 to less than 1 |

| 3 | Low to medium | 1 to less than 2 |

| 4 | Medium | 2 to less than 3 |

| 5 | Medium to high | 3 to less than 4 |

| 6 | High | 4 to less than 6 |

| 7 | Very high | 6 or greater |

There are different types of risks that you need to consider as they can all have an impact on your investment returns.

Superannuation, like any investment, has risks. While these risks can often be managed and even minimised, they cannot be eliminated.

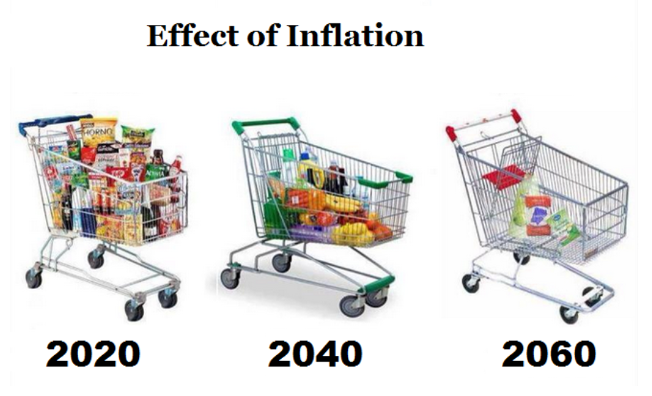

Inflation is one of the risks you need to consider. Over time, inflation reduces the value of money, meaning the savings you have now will be worth less in the future, or what you can buy with $1 now is more than you will be able to buy in the future.

In addition to inflation risk, other significant risks should be considered in your decision-making process. Some of these risks include:

| Risk Area | Risk |

|---|---|

| Currency risk | A change to currencies relative to the Australian dollar can change the value of the investments located outside Australia. |

| Fund risk | Risks of the fund include that it could cease operation, fraud could occur, company restructure and /or our investment professionals could change. |

| Interest rate risk | Interest rate changes can have both positive and negative impacts directly or indirectly on investment values and returns. |

| Investment risk | The underlying assets of the investment options can fall in value for many reasons, such as changes in the internal operations or management of a fund or company, or in its business environment. |

| Liquidity risk | Under certain market conditions the underlying assets of the investment options can become difficult to trade and liquidate. |

| Market risk | The value of investments can be affected both positively and negatively by various events such as economic change, technological changes, political or legal conditions, and even market sentiment. |

| Superannuation law changes | Changes to superannuation laws are frequently made and may affect your investment and/or your ability to access your super. |

| Tax law changes | Changes to tax laws are frequently made and may affect your investment. |

Asset classes typically available within Superannuation

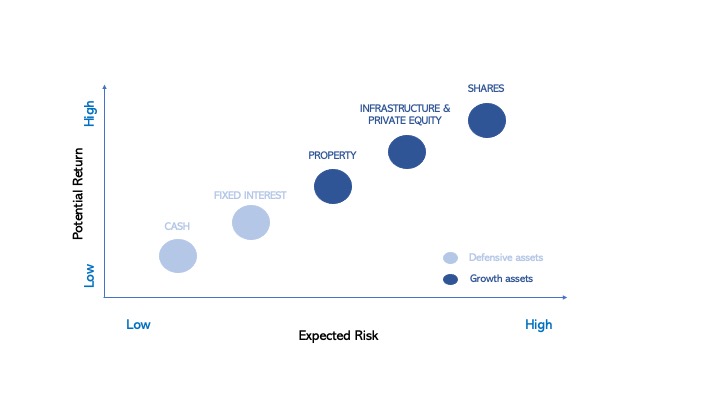

Asset classes are the building blocks of your investments and are commonly grouped as defensive or growth depending on their different characteristics. The exposure you have to each asset class should normally be decided upon based on your risk/return profile – i.e. how much risk you are willing to take on in order to achieve the returns you need to accomplish your retirement goals.

The different characteristics of growth and defensive assets are outlined below:

| Types of assets | Defensive | Growth |

|---|---|---|

| Asset classes |

|

|

| Risk / Return characteristics | Lower returns and less volatility over the long term than growth assets. | More volatility and risk than defensive assets, however with a higher potential return over time. |

| Within a portfolio | Stabilise and diversify returns | Deliver higher growth over the long term |

Generally, the higher potential returns of an asset class, the higher the risk associated with that asset class.

As shown in the table above, shares are a growth investment and tend to exhibit higher returns over time but at a higher risk. In contrast, Cash and Fixed Interest are seen to carry lower levels of risk but with a lower potential long-term return. It is important to remember that returns may not always be positive, regardless of the asset class in which you are invested.

More detailed descriptions of the typical asset classes available within superannuation are provided here.

Diversifying your investments can lower volatility and risk

Diversifying your investments across different asset classes means you have a mix of investments that can help to lower the volatility of your returns. It is common to see different asset classes performing differently from one another at times, and over time. By choosing to mix your exposure to growth and defensive asset classes, and mix your exposure to assets within asset classes (for example, between international shares and Australian shares) the fluctuations in your portfolio returns can be smoothed over time. This is because if one of the investments in your portfolio is performing poorly at a particular time, then these poor returns can be offset by better performance from another of the asset classes in which you have chosen to invest.

Review your situation regularly to ensure your investments remain aligned to your risk and return profile.

Your investment strategy should consider all aspects of your unique situation and aspirations for the future. If and as your circumstances change, it’s important that your financial plan and risk/return profile is updated accordingly. This may result in a change to your chosen investment option(s).

It is always advisable to seek financial advice from a professional to help you plan your financial future.

Issued by Diversa Trustees Limited (ABN 49 006 421 638), (AFSL No 235153).

This article is general advice only and does not take into consideration your personal objectives, financial situation or particular needs. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser.